Latest Newsletter

Back to School Educator Deductions

If you are an eligible educator, you may deduct up to $300 from trade or business expenses. Joint return filers who are both educators may deduct up to $300 per spouse.

You may qualify for this deduction if you work as a teacher, counselor, principal or aide for grades K-12 in a public or private school. You generally must work at the school for at least 900 hours during the school year.

Eligible classroom expenses include:

- Books, supplies and materials that you purchase for classroom use

- Classroom equipment, including computers, peripherals and software

- Items such as hand sanitizer and masks purchased to prevent the spread of COVID-19

Tuition and fees for professional development courses may also qualify for the Educator Expense Deduction. However, you may get a larger tax benefit by claiming the Lifelong Learning Credit or a different deduction for these costs.

Check out Modi’s Tax On Google!

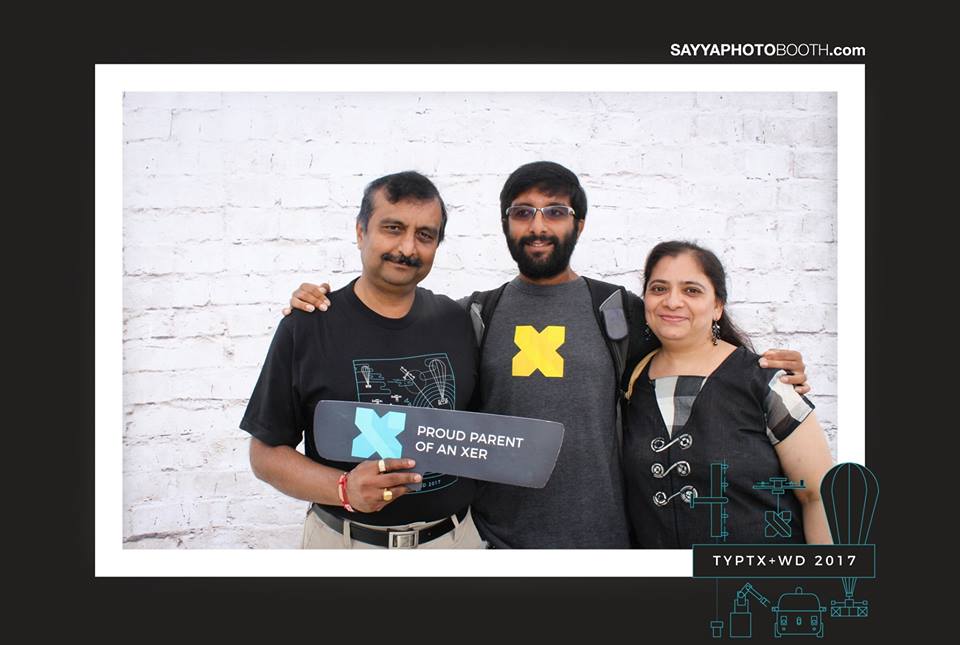

We were also there at Google!

Take Your Parents To Work Day Sep 7 2017. Proud Parents Of Googler

Parents Day Sep 10 2015. Happy Parents Of Googler

Check out Modi’s Tax on Yelp!

Go East or West Modi’s Tax is always the BEST

“We make filing your taxes a less taxing experience.”

Call us for an initial consultation (408) 735-7351

You can easily find us on Google Maps