Latest Newsletter

IRS Delays Implementation of New Rules for 1099-K Forms

Under a new rule enacted in 2021, third-party payment processors must issue a Form 1099-K to any individual who receives $600 or more in payments for goods or services during a year. However, IRS officials have noted that this rule could cause widespread confusion, since many transactions completed through online payment platforms have no tax impacts. Examples of non-taxable transactions include settling up with friends and selling used personal items.

Therefore, the IRS will not enforce the new rules for tax year 2023. Instead, third-party payment processors may operate under the prior rules, only sending 1099-K forms to users who received over $20,000 in payments through over 200 transactions. In addition, 2024 will serve as a phase-in year, with the 1099-K reporting threshold set at $5,000. Full implementation of the $600 threshold will not occur until at least 2025.

Check out Modi’s Tax On Google!

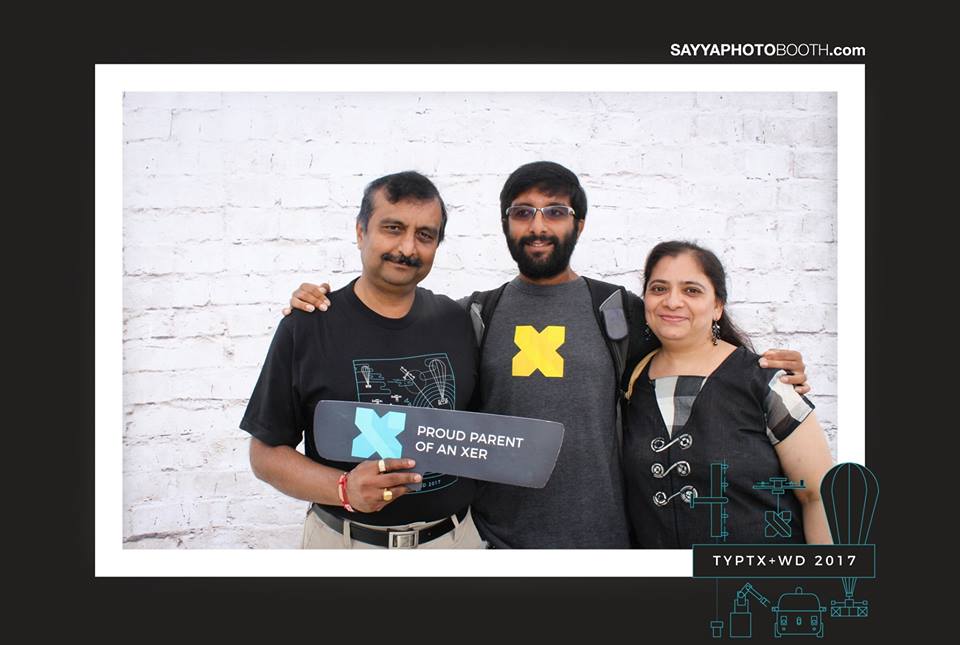

We were also there at Google!

Take Your Parents To Work Day Sep 7 2017. Proud Parents Of Googler

Parents Day Sep 10 2015. Happy Parents Of Googler

Check out Modi’s Tax on Yelp!

Go East or West Modi’s Tax is always the BEST

“We make filing your taxes a less taxing experience.”

Call us for an initial consultation (408) 735-7351

You can easily find us on Google Maps